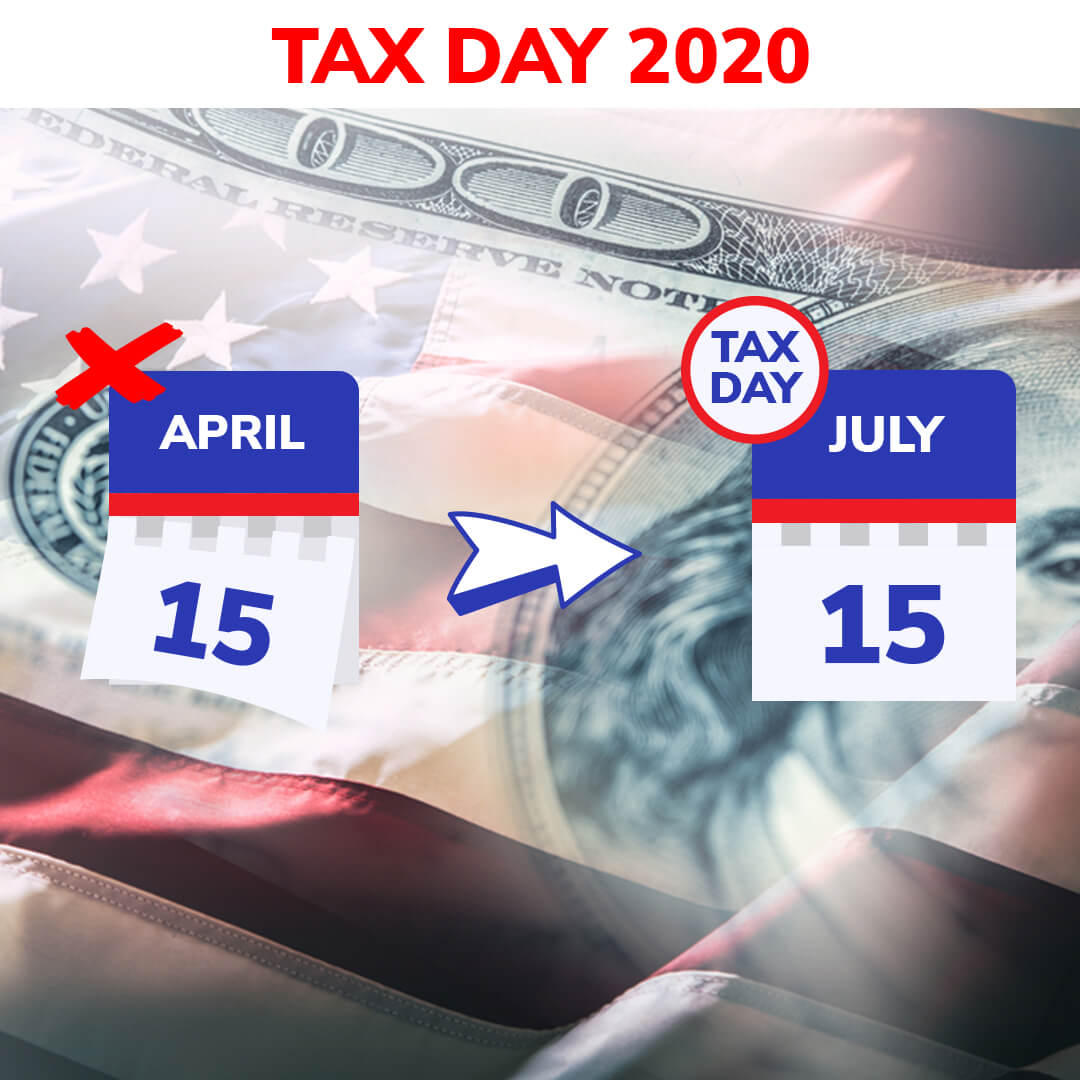

When is tax day 2020?

Deadline for U.S Expat tax filing in 2020

On the basis of calendar year, the due date for filing your U.S tax return is April 15 of the following year Calendar year 2019 -. If one files on a fiscal year basis (a year ending on the last day of any month except for December), the due date will be 3 months and 15 days after close of your fiscal year.

What happens when the due date for filing your tax return falls on a weekend or legal holiday? Thought of missing the due date triggers panic right! Worry not, in such a case the due date is delayed until the next business day. The last day to file taxes for the year 2019 is April 15, 2020 but given the current COVID-19 crisis the deadline has been extended to July 15, 2020.

What is the deadline for taxpayers residing outside the U.S?

2-months automatic extension

The due date for filing U.S tax return is April 15 for most of the tax payers. What if the taxpayer is outside U.S? Then in such a scenario, the due date for filing federal tax return is June 15, which deduces that if you are outside U.S then you are allowed an automatic extension of 2-months, without filing form 4868 to file your return.

How do you get an automatic 2-months extension?

To avail the automatic 2-months extension, a statement needs to be attached to your return which explains that on the regular due date (i.e. April 15) of return, you are

- Living outside the U.S, and

- Your main place of business or post of duty is outside U.S

This, thus help you qualify for the extension.

What to do in case you are not able to file your returns by June 15? You can request for an additional automatic 6-months extension.

Additional 6-months automatic extension

In case you are not able to file your returns by the automatic 2-months extension date, you can request for additional 6-months automatic extension to file your return, this means now the due date to file return becomes October 15, 2019. One clearly needs to take a note that this form needs to be filed before the 2-months automatic extension date, that is, before June 15.

How do you get an automatic 6-months extension?

You are required to file either a paper form 4868 or use IRS e-file (electronic filing). Form 4868 helps you get an automatic 6-months extension, and should be filed no later than the original due date of the return. You should note that the form reflects estimated tax liability properly based on the information available to you.

When are you not eligible for the automatic 6-months extension?

- You want IRS to figure your tax, or

- You are under court order to file by the due date.

Interests and Penalties

You should keep in mind that these extensions are only to file and not to pay, which means that if you have tax that is due, you are required to pay it by April 15. If you fail to clear the tax due, then interest will be charged on the balance from April 16 till June 15 or till the date you file your return. Any payment with respect to any tax due after June 15 will not only be subjected to interest charges but also failure to pay penalties.

How do I claim foreign earned income exclusion?

Confused how to claim your exclusion? Worry not, to claim your foreign earned income exclusion (form 2555), the foreign housing exclusion, or the foreign housing deduction; you are required to meet all the three conditions mentioned below:

- Your tax home must be in a foreign country.

- You must have foreign earned income.

- You must be one of the following:

- A U.S. citizen, who is a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year.

- A U.S. resident alien, who is a citizen or national of a country with which the United States has an income tax treaty in effect and who is a bona fide resident of a foreign country or countries for an uninterrupted period that includes an entire tax year.

- A U.S. citizen or a U.S. resident alien, who is physically present in a foreign country or countries for at least 330 full days during any period of 12 consecutive months.

Additional 1-month extension (Extension of time to meet tests)

Here additional one month means total of 7-months extension that is till November 15. One does not get more than six months of extension; however you may be able to get a longer extension if you meet the requirements mentioned below:

- You are a U.S. citizen or resident alien,

- You expect to meet either the bona fide residence test or the physical presence test, but not until after your tax return is due and,

- Your tax home is in a foreign country (or countries) throughout your period of bona fide residence or physical presence, whichever applies.

If an extension is granted to you, it generally is 30 days beyond the date on which you can expect to qualify for an exclusion or deduction either under bona fide residence test or the physical presence test. This will thus make the due date for filing your U.S tax return November 15.

If you are a U.S citizen or a resident alien of the U.S living abroad, you will be taxed on your world income. You may however qualify to exclude $103900 of your income from your foreign earnings.

How do I get extension for Form 2555?

You are required to file form 2350 either by mailing it to the department of treasury, Internal Revenue Service Centre or by giving it to a local IRS representative.

It is mandatory for you to file this form by the due date for filing your return (June 15) along with form 4868 or by the extended due date (October 15)

USTAXFiling can help you understand your tax modalities, prepare and file your returns online through our team of experienced tax experts!